Article originally published on Open Democracy

As Uzbekistan turns to privatisation to solve forced labour in the state-controlled cotton sector, an investigation into an international equipment contract raises red flags over business practices and government control.

- The systemic use of forced labour in Uzbekistan’s state-managed cotton sector saw the country blacklisted from lucrative western markets

- In 2017, Uzbekistan’s government began a far-reaching privatisation programme designed to expand the garment sector, eradicate forced labour – and win back western brands

- A cache of leaked records document irregular transactions between one of Uzbekistan’s largest textile firms, the Uztex group, Swiss multinational Rieter and a little known British trade agent

- These records point to a wider problem: lax corporate practices in Uzbekistan, and the complicit role of western jurisdictions, will complicate the country’s re-integration into a global economy where there is growing demand for responsible sourcing

Since 2017, Uzbekistan has initiated one of the more ambitious privatisation efforts in its post-Soviet history, with the Central Asian republic’s state-managed cotton sector being rapidly handed over to local corporate operators and foreign investors.

It’s not just about the familiar economic and political questions large-scale privatisation provokes. Some hope it will help address the labour abuses that have tarnished Uzbekistan’s cotton sector. For years, children, public servants and even doctors have been forced into the cotton fields to meet targets in a key export area.

By taking the state’s authoritarian hand out of the cotton sector, and replacing it with private commerce, the Uzbek government expects that technological innovation will improve, value-added production in garments and textiles will expand, and ultimately the systemic abuse of labour will end.

The Uzbek government also anticipates that the privatisation programme will convince international apparel brands, who have blacklisted Uzbek cotton products over human rights concerns, to re-engage.

Yet with little transparency, and no apparent vetting of the corporate beneficiaries, handing over this sector to private interests is replete with risks, set against an international context where apparel brands are increasingly conscious of maintaining integrity in their extended supply chains.

One company leading this privatisation effort in Uzbekistan is the Uztex group. Established in the 1990s by Uzbek businessman Fakhritdin Mamatdjanov and his son Farkhod, Uztex is now one of the largest textile conglomerates in Uzbekistan – and the public face of the Uzbekistan government’s ambitious privatisation programme. The company was singled out by The Economist last year in its praise for the cotton privatisations. “On Uztex’s factory floor,” the magazine wrote, “a smiling seamstress holds up a t-shirt emblazoned with a slogan that seems to speak to the industry’s aspirations. ‘Ready to be different,’ it reads.”

Internal Uztex records, obtained as part of a year-long study conducted by Ulster University in partnership with the Uzbek Forum for Human Rights, tell a more concerning story. These documents raise questions about how different the group is from some of the unsavoury firms that have historically dominated Uzbekistan’s most lucrative sectors – and the role of western companies in enabling them.

Emails, bank statements, contracts and internal corporate records document a secretive transnational network of companies in Uzbekistan, Switzerland and the UK.

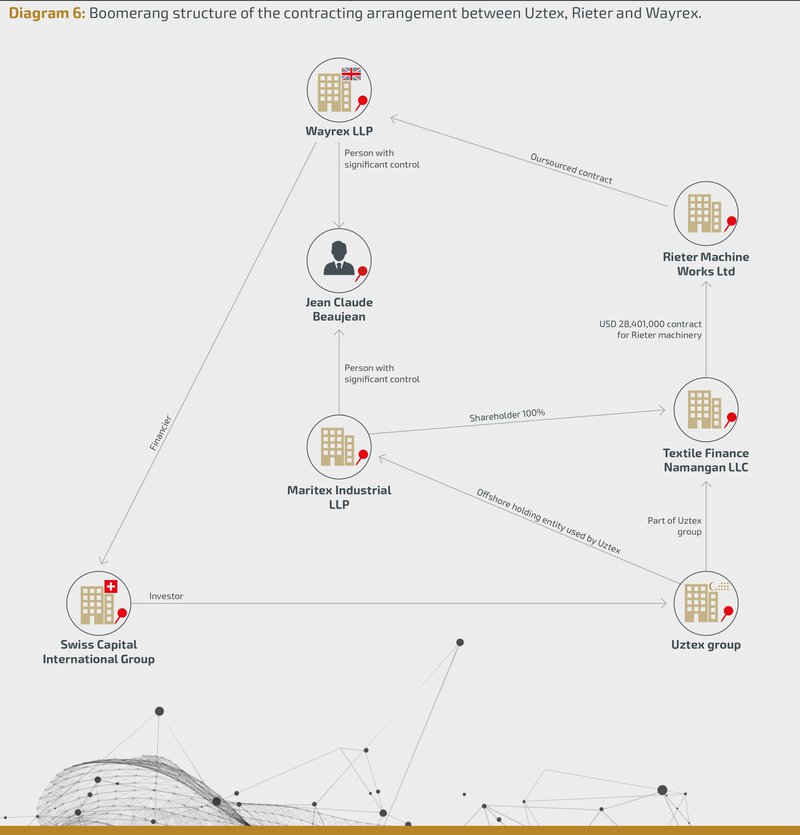

Several contracts between leading Swiss industrial combine Rieter and Uztex group companies raise further concern. In these contracts, Uztex initially agreed to purchase US$84 million in textile machinery from Rieter. Uztex then consented to Rieter outsourcing the job to a British firm, Wayrex LLP.

Wayrex is a little known English trade agent, which public documents and internal records indicate is a key part of Uztex’s offshore holding structure. This poses a question: Why would one of Uzbekistan’s largest textile firms enter into a multi-million dollar equipment contract with a prestigious Swiss supplier, only then to agree to outsource this large-scale job to a small British offshore vehicle apparently in its own group structure?

Uztex and Farkhod Mamatdjanov have not responded to the study’s requests for comment. Rieter stated it was “common practice in our industry that machine manufacturers like Rieter are trusted with the coordination of different suppliers.”

Uzbekistan is a critical regional sales portfolio for Rieter, a major Swiss supplier and manufacturer of textile machinery globally. Rieter’s 2018 annual report states the company “increased sales in the reporting year by 36% to CHF 433.9 million [approx. £345m], of which Uzbekistan made a significant contribution of CHF 144.1 million”.

Uztex group is one of Rieter’s regular clients, and the commercial relationship between them raised a number of red flags during the investigation conducted by Ulster University and the Uzbek Forum for Human Rights.

In due diligence terms, red flags are factors that regulatory authorities, researchers and other specialists have credibly tied to improper or illegal practices, from a risk perspective. Secrecy with respect to owners and managers, financial records that appear improbable, the use of nominee director or shareholders (individuals paid to formally appear on public filings, but who have little or no practical involvement in the firm), and company agents tied to problematic litigation, serious allegations of impropriety, or criminal investigations, are all examples of red flags.

It cannot be inferred from red flags that illegal or improper activity has taken place. However, regulators use red flags to prioritise limited resources on higher risk actors, while companies conducting due diligence on clients and customers would exercise special caution before entering into contractual relations with a party exhibiting multiple red flags for which they cannot provide a satisfactory explanation.

According to documents in the author’s possession, during 2017 Uztex negotiated an order for US$84 million in textile machinery from Rieter. Due diligence checks conducted on the contracting parties by the author revealed several red flags.

This machinery was supposedly destined for two key Uztex operations, Textile Finance Khorezm and Textile Finance Namangan – named after regions in the north-west and east of Uzbekistan, respectively.

“From Rieter’s perspective, there is no doubt that the transaction served to build a spinning mill,” the manufacturer stated in response to Swiss newspaper Tages-Anzeiger. “All machines and facilities were either contracted by Rieter or subcontractors and the spinning mill is in operation.”

When the author checked Uzbekistan’s commercial register in 2019, Textile Finance Khorezm shares were primarily held (96.59%) by Swiss Capital International Group AG (SCIG).

SCIG presents itself as a diversified investment company. It is publicly fronted by two Swiss-based investment managers who sit on its supervisory board. They are from a company called Practical Executives, whose tagline is “You run your business – we run for you your company.” While this is a legitimate corporate service, it does mean that those who control the substantive business operations can be hidden, and the public can only see the people who administer the legal entity in Switzerland. Entities incorporated as Aktiengesellschaft (AG, or joint stock company) in Switzerland also do not have to publicly declare their shareholders or beneficial owners. As a result, AGs are a popular secrecy vehicle.

Leaked internal records indicate SCIG is controlled by Farkhod Mamatdjanov – the Chairman and reported owner of Uztex group. This fact is not apparent based on publicly available records, or the private share registry documents which are not available to the public. From a due diligence perspective, the masking of persons with significant control through a complex legal structure is a serious issue. It prompts the question: why would a controlling mind behind a company take concerted efforts to conceal their identity? Such efforts are frequently linked to operations involved in improper or illegal conduct. It is considered a serious red flag in due diligence manuals for risk professionals.

SCIG, which did not respond to a request for comment, has also been a major investor in Uztex and Invest Finance Bank. The latter counts Gulnara Karimova, the imprisoned daughter of Uzbekistan’s former president Islam Karimov, among its previous clientele.

According to Tages-Anzeiger, Rieter has been approached by the Swiss federal prosecutor’s office in connection with proceedings against Karimova, who previously did business with Uztex’s owners. “The federal prosecutor contacted Rieter in 2016 and had access to the required documents,” Rieter said to Tages-Anzeiger. “Rieter has cooperated extensively with the federal prosecutor. The company does not comment on proceedings in which Rieter is not a party.”

According to a Russian court decision, in 2016-2017 the general director of a large Russian dairy plant once part-owned by SCIG warned Uzbek authorities of alleged criminal activities perpetrated by Mamatdjanov and his colleagues, claiming that they were using SCIG as an anonymous front. SCIG and Mamatdjanov were unsuccessful in defamation proceedings launched against the general director over these claims.

A 2019 Russian court judgement on the seizure of property belonging to “Swiss [redacted]” confirms the existence of a criminal investigation into Mamatdjanov led by Russia’s Ministry of Internal Affairs.

Like with Textile Finance Khorezm, the other Uztex operation looking to purchase Rieter equipment, Textile Finance Namangan, exhibited an ownership structure with red flags.

Textile Finance Namangan shares were 100% owned by Maritex Industrial LLP, another apparent Uztex offshore vehicle incorporated in the UK. Maritex Industrial’s person with significant control (PSC) is Jean Claude Georges Paschal Theodore Beaujean, who is listed as Belgium’s honorary consul to Uzbekistan. (Belgium’s foreign affairs press office did not respond to multiple requests for confirmation, nor did Beaujean himself.) The basis for this PSC declaration is that Beaujean exercises significant control over Maritex Industrial LLP, rather than because he is a beneficial owner. Beaujean is also the PSC for two other apparent Uztex entities in the UK, as we will see.

In its latest filings, Maritex Industrial LLP describes itself as a trade agent for textile goods, with income of £4,982 in 2019.

Leaked documents reveal that four contracts for the purchase of Rieter equipment by Uztex were prepared in 2017. The first is dated 10 May 2017 and is between Textile Finance Khorezm and Rieter Machine Works. The price was US$55,186,400.

The second equipment contract is dated 27 September 2017. It is between the second Uztex vehicle, Textile Finance Namangan, and Rieter Machine Works. The price was US$28,401,000.

Then there are two three-way agreements. The first features Textile Finance Khorezm, Rieter Machine Works and Wayrex LLP; the second involves Textile Finance Namangan, Rieter and Wayrex.

Under these agreements, Wayrex was charged with sourcing the equipment which Rieter was originally contracted to supply.

UK filings for Wayrex LLP declare one PSC, Jean Claude Georges Paschal Theodore Beaujean – the man who is also registered as PSC for Maritex Industrial LLP. Internal SCIG correspondence suggests, however, that Wayrex LLP is ultimately controlled by Farkhod Mamatdjanov, and it forms part of Uztex’s offshore structure.

This raises the question of why Uztex would contract to buy equipment from Rieter, only then to strike an agreement that would see the job outsourced boomerang-style back to Uztex, with the purchase price paid initially to Rieter, and then transferred on to Wayrex LLP, an apparent Uztex-tied offshore entity, upon receipt by Rieter of relevant documentation relating to the outsourcing agreement. .

Rieter group general counsel Thomas Anwander responded to questions on the deal with Wayrex LLP, noting: “It is a common practice in our industry that machine manufacturers like Rieter are trusted with the coordination of different suppliers.”

But Wayrex LLP was not a supplier. It appears to be an offshore holding vehicle used by Uztex. And yet Rieter contracted Wayrex to source the equipment from suppliers and facilitate their installation in Uztex premises.

A copy of the contract signed by Rieter states: “Wayrex will instruct these suppliers to invoice their delivered goods and services directly to Wayrex. Wayrex will thereafter invoice to [sic] Rieter”.

The money goes on a round trip too. Under the first set of contracts, Uztex companies commit to pay Rieter Machine Works. Once payment is received, Rieter Machine Works commits under the second contract to reimburse Wayrex for equipment it sources from third parties to complete the deliverables envisaged in the original contracts.

From an anti-money-laundering perspective, these types of layered transactions, where money makes a round trip through ostensibly legitimate commercial transactions, only to arrive back at its point of origin, are a red flag which requires explanation.

Uztex and Farkhod Mamatdjanov did not respond to requests for comment.

Due diligence

On the basis of public record information available at the time in 2017, things should have looked askew to Rieter.

Annual accounts for Wayrex LLP from this period are signed by controversial companies nominee Ali Moulaye, whom a Buzzfeed investigation found to have signed off on 127 accounts for companies connected to money-laundering. The filed accounts claim Wayrex LLP is “active as trade agent for polymeric raw materials and received commission”. In 2017, these commissions totalled £27,413.

There is nothing in these public filings with UK Companies House to suggest Wayrex LLP has experience in sourcing industrial-scale textile machinery. In fact, Wayrex LLP’s financial activity denotes a micro-scale firm. When contacted, the company did not respond.

Its PSC declaration raises another red flag. When the contracts were drawn up with Rieter in 2017, Wayrex LLP had declared one person with significant control, Jean Claude Beaujean. As mentioned earlier, Beaujean was also the PSC for Maritex Industrial LLP, the apparent Uztex offshore vehicle which holds shares in Textile Finance Khorezm. And he was also the PSC for DF Industries LLP, another offshore vehicle apparently used by Uztex. Public filings in Uzbekistan at the time showed that both LLPs were tied into Uztex’s ownership structure.

Even a basic media search conducted in 2017 would have suggested that Uztex and Wayrex were part of the same consortium. A British government media release from February 2016, for example, notes the visit of a deputy British ambassador to Uztex Shovot, “which is part of the Wayrex LLP company”.

In response to these concerns, Rieter’s Thomas Anwander notes that only the contract between Rieter, Wayrex LLP and Textile Finance Namangan went ahead.

Further investigation revealed Rieter has multiple links to Uztex, which suggest it was in a strong position to know its clients and identify red flags.

There is the example of TashBrunnentex, which was later renamed Uztex Tashkent – a joint venture established between Wayrex LLP and a Swiss firm Chastex AG, which went into liquidation in 2011. Chastex AG’s sole director was Markus Waldvogel, an executive who served at Wayrex LLP from 2008-2013, and SCIG from 2013-2014.

Rieter Machine Works Ltd has retained a 3.52% stake in Uztex Tashkent.

When approached for comment on Rieter’s equity interest in Uztex Tashkent, Rieter’s Anwander initially claimed “this information is not correct”. After the author sent him Uztex Tashkent’s company extract, he clarified: “Rieter Machine Works Ltd. received some shares in a company called TashBrunnentex in the context of a financial restructuring about 10 years ago. We thought these shares have been divested in the meantime […] We will now initiate the necessary actions to dispose these shares in due time.”

Beyond shared corporate interests, there has been overlap in personnel between Uztex and Rieter. Between 2015-2017, a former HR boss at Rieter, Jürg Wieser, served as a director of SCIG – the entity apparently controlled by Uztex owner Farkhod Mamatdjanov that in 2019 owned nearly all of a key Uztex operation.

Jens-Uwe Bockhahn, who is listed as Rieter Central Asian Sales manager in 2010, and since 2006 a Rieter Machine Works manager, served as an SCIG director in 2011.

Then there is the example of senior Rieter linked executives, Alisher and Muzaffar Razakov. Muzaffar Razakov is CEO of Rieter Uzbekistan. On LinkedIn, Alisher Razakov is listed as head of Central Asia for Rieter Machine Works Ltd. In media reporting he is referenced as Rieter’s agent in Uzbekistan.

Internal SCIG correspondence suggests Farkhod Mamatdjanov and Alisher Razakov work closely together. Both are copied into a highly sensitive SCIG email exchange with SCIG’s then president Peter Schafflützel.

This email exchange refers to Farkhod Mamatdjanov as the ultimate owner of SCIG. The emails make multiple references to both Mamatdjanov and Alisher Razakov being consulted on a proposed increase in SCIG’s capital.

A leaked 2016 annual statement for Mamatdjanov’s Lichtenstein bank account with VP Bank also documents ties to Alisher and Muzaffar Razakov. A CHF3 million (approx £2.1m) deposit was made into Mamatdjanov’s account on 28 April 2016, with the description “Herr Alisher Razakov U/O, Herr Muzaffar Razakov”.

Following this transfer, Mamatdjanov paid CHF946,676 (approx. £669,962) to Prospera AG, and CHF1,893,344 (approx. £1,339,919) to Hardturm AG. These companies are the developers of the exclusive Hardturm property complex in Zurich. This would appear to be a legitimate transaction for a property purchase. Shortly after this payment was made, SCIG shifted its headquarters to this luxury Zurich estate. Its address – 98 Pfingstweidstrasse – has been used by Alisher Razakov in his UK corporate filings.

Alisher Razakov did not respond to a request to comment. When the VP Bank statement was provided to Rieter, their general counsel noted: “The copies you provided us show transactions between Mr Mamatdjanov and Mr Razakoff’s private bank account. Obviously these transactions do not relate to any business matters, so we are [sic] in the position to comment on them.”

This evidence indicates that Reiter were well positioned to appreciate the irregular features of the proposed contracts with Uztex and Wayrex LLP, which given the circular nature of these agreements, and the involvement of opaque offshore entities, should have prompted extreme caution. Rieter has not referenced any enhanced due diligence conducted in its communication with the author, nor has it accepted or acknowledged the risks present in the transaction structure .

Speaking to Tages-Anzeiger, Rieter stated that “We contest the claim that Rieter was involved in transactions that are not in compliance with the law”

Corporate accountability and risk in Uzbekistan

The structure and operations of Uztex group are not unusual. A systematic sectoral study conducted by Ulster University and the Uzbek Forum for Human Rights indicates worrying corporate traits are present in a statistically significant proportion of the companies selected by the Uzbek government to benefit from the cotton privatisation effort.

Following the death of Islam Karimov in 2016, Uzbekistan’s new president Shavkat Mirziyoyev has cultivated the image of a business-friendly moderniser.

But his government has demonstrated little appetite for opening up operations such as the Uztex group to greater transparency and accountability.

Secretive conglomerates in effect enjoy the best of both worlds. Liberal financial, corporate and investment regimes in Europe and Asia, fused with opaque authoritarian lines of power in Uzbekistan.

The potential of projects such as Uzbekistan’s cotton privatisation will invariably be put at risk by the type of practices that a lax and opaque governance framework incentivises. It also raises questions about the complicity of jurisdictions such as Switzerland and the UK, which provide the infrastructure for the footloose movement of capital, assets and the business elite – without the checks and balances needed to comprehensively identify and prosecute abuse.

All images courtesy of Ulster University and Uzbek Forum for Human Rights.